A Boutique High Yield Fund of Funds

EARN 18% PER YEAR

We are like Costco—But for Investment Funds

We negotiate exclusive deals with emerging fund managers—so you get private access!

| Investor Class |

Targeted Annualized Cash-on-Cash Return |

Payout Method |

|---|---|---|

| A (Income) | 14% | Monthly (1.17/Mo.) |

| AA (Income) | 16% | Monthly (1.33%/Mo.) |

| AAA (Income) | 18% | Monthly (1.50/Mo.) |

Focused on Cash Flow

Unique, High Demand Niches

Monthly Income

Investments in industries with strong profit margins

Liquidity within 3–6 months

Emphasis on risk-mitigation strategies and capital preservation

Important Disclosure:

This material is provided for informational purposes only and does not constitute an offer to sell or a solicitation to buy securities. Any offering is made solely pursuant to the fund’s confidential offering documents. The investment described herein is offered under Rule 506(c) of Regulation D to verified accredited investors only.

Targeted returns and distributions are not guarantees of future performance. All investments involve risk, including the possible loss of principal. Liquidity, distributions, and returns are subject to fund terms, market conditions, and other factors.

HOW IT WORKS

Designed for income-focused investors seeking consistent cash flow from hard to find, private market strategies.

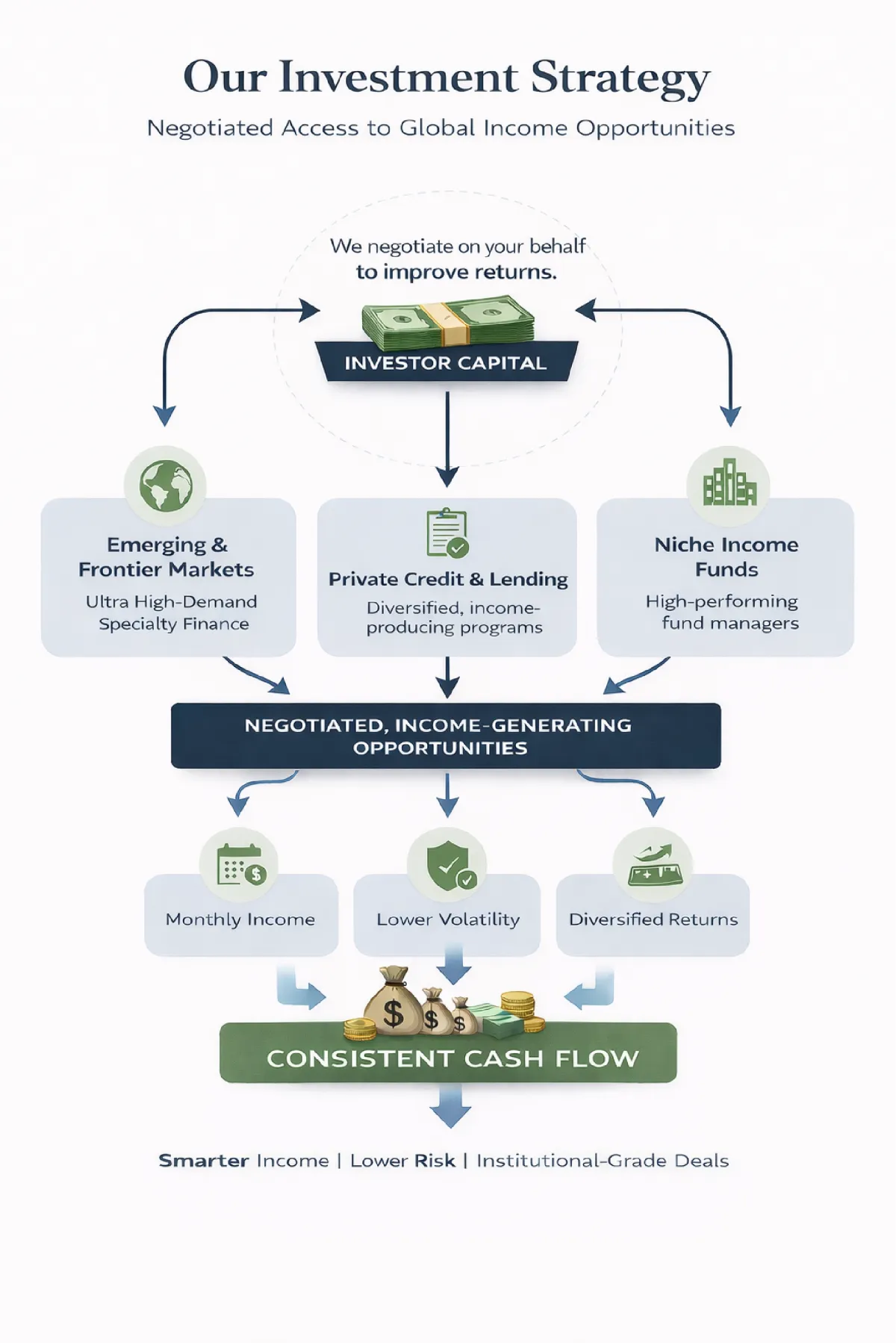

INVESTMENT STRATEGY

We find off-the-radar funds that big institutions overlook—and pass the advantage to you.

Targeted Return Objectives

Targeted annual returns of approximately 15%–17%, with monthly income payments.

Our Focus

We focus on steady income, not volatility.

Our goal is to invest capital in private opportunities that are designed to generate reliable cash flow, including:

Monthly or quarterly income streams

Future cash-flowing royalties

Short- to mid-term liquidity options, so we can get out if it gets risky

Deal structures designed to help limit downside risk

Access to proven, emerging, and niche markets that are often hard to reach

Where We Invest

We take a global approach, with an emphasis on high-demand, cash-flowing opportunities across a range of industries and geographies.

Risk Management

We believe protecting capital comes first. We prioritize investments that typically offer:

Real-world use cases, such as financing cash-flowing businesses

Repeatable income from diversified sources

Operators with transparent reporting and verifiable track records

Income and liquidity features designed to align with investor needs

The Result

A diversified income-focused strategy designed to provide:

Global exposure across multiple opportunities

Access to institutional-style private deals

More thoughtful entry points and negotiated terms

— without the need to source opportunities or vet managers on your own.

Ryan Watkins

Founder & Managing Member of Barrett Creek Investment Advisors

General Partner of Barrett Creek Capital Partners, LP

Ryan Watkins is the founder and CIO of Barrett Creek Investment Advisors, and managing partner of Barrett Creek Capital Partners, LP—a global fund of funds focused on negotiating exclusive access to income-producing investment opportunities across high demand and emerging market opportunities.

With over 30 years of trading and investing experience, Ryan brings a disciplined, results-driven approach to capital allocation and fund strategy.

Over his career, Ryan has:

Founded multiple companies, including Trader Tactics

Served as Director of Trading Operations for a U.S.-based commodity firm

Advised hedge funds and trained thousands of traders and investors globally

Built and implemented trading systems and SaaS tools still in use today

Graduated top of class in a competitive hedge fund internship program

Ryan’s deep expertise spans proprietary trading, alternative investments, global micro-lending, and financial education. His leadership is defined by a strong track record, innovation, and a hands-on understanding of what drives income and outperformance—especially from emerging managers and niche fund strategies.

He has been a featured speaker and contributor to platforms like CNBC, TheStreet.com, Active Trader, and Amazon, and has won multiple awards for excellence in financial education and content creation.

“I created Barrett Creek to level the playing field. Retail investors deserve access to smarter, more negotiated opportunities—just like the big players.”

Frequently Asked Questions

Find answers to common inquiries about our financial advisory services.

What is Barrett Creek Capital Partners, LP?

Barrett Creek Capital Partners is a private investment fund that pools investor capital and allocates it into income-producing opportunities—primarily through negotiated partnerships with other emerging funds and global lending businesses.

We specialize in securing exclusive investment terms typically not available to individual investors on their own.

Is this like a hedge fund?

Not exactly. We are structured as a Fund of Funds—which means we invest in other professionally managed funds businesses or lending vehicles.

Our focus is on income and cash flow, not aggressive speculation.

Who manages the fund?

The fund is managed by Barrett Creek Investment Advisors, led by founder and CIO Ryan Watkins, who has over 30 years of experience in trading, investing, and global finance, including, a U.K. based hedge fund, a Commodity Trading Investment Fund he co-founded and an award-winning trading and investment course writer.

How often do I get paid?

The fund targets monthly income distributions, depending on the specific investments and structures. Some investments may distribute quarterly. Details are shared during onboarding.

Are returns guaranteed?

No. All investments carry risk, and while our goal is to provide consistent income, returns are never guaranteed. We focus on income-producing strategies and try to mitigate risk through manager selection and deal structure.

Will I receive tax documents?

Yes. You will receive a K1 or similar reporting documentation annually, depending on the structure of your investment and distributions.

What types of investments do you make?

We invest in:

✔ Consistent cash-flow-producing opportunities both domestically in the US and internationally.

✔ High demand, high growth opportunities in frontier and emerging markets

✔ Private credit and income-producing debt strategies

✔ Niche fund managers with strong early performance

How do I invest?

You can apply to invest by contacting us directly through the CONTACT page. We’ll walk you through the simple onboarding process, documents, and funding instructions.

What’s the minimum investment?

Minimums vary by offering, but generally start around $50,000. This helps us keep the fund lean and focused.

Is my money locked up? Can I withdraw?

We do not require a formal lock-up period but for the fund to operate effectively, we ask you commit, in good faith, to at least 12 months. In general, withdrawals require advance notice and we return funds back with six months.

Who can invest in the fund?

Only accredited investors as defined by U.S. securities laws can invest. This typically includes individuals with:

✔ $1 million+ net worth (excluding primary residence), or

✔ $200,000+ annual income ($300,000+ with a spouse)

How can I get more information?

Reach out via our Contact Page. We’re happy to answer your questions and walk you through the process.

Barrett Creek Investment Advisors

General Partner of Barrett Creek Capital Partners, LP

205 North 18th Street, Suite # 5, Middlesboro KY 40965

For Media Requests:

We respond promptly to qualified media requests.

Members of the press are welcome to contact us regarding Barrett Creek Capital Partners, LP, our investment strategy, or our leadership’s perspective on global income investing, and emerging fund managers.

Please include your name, outlet, deadline, and topic of interest. Interviews may be subject to availability.

STRATEGIC PARTNERS

“We believe the best opportunities often come from those closest to the ground. If you're creating value and generating income, we want to help you scale.”

Let’s Build Smarter Capital Together

we specialize in sourcing high-quality, income-generating opportunities through strategic partnerships with emerging fund managers, lending platforms, Saas platforms and global operators. If you're managing a fund or business, structuring income deals—we want to hear from you.

What We Look For

We partner with managers, platforms, and businesses that are:

Focused on income-producing assets or consistent cash flow models

Led by capable, agile operators—often emerging managers with strong early performance

Operating in overlooked or inefficient markets, where access and capital make a difference

Whether you're raising capital for a cash flowing program, a high-yield credit strategy, or a niche global income vehicle—we may be able to help accelerate your growth.

Why Partner With Barrett Creek?

Flexible capital: We can move early, small, and fast—especially where institutions hesitate

Long-term alignment: We care about sustainable cash flow and repeatable success

Simplified onboarding: We manage the complexity on our side so you can focus on results

Access to U.S. capital: Our structure opens up U.S. investor capital for global deployment

Let’s Talk

If you’re a fund manager, business operator, or platform looking to grow—and your model produces consistent income—reach out. We’re always open to building new relationships.